Background information

Forget Labubu, check out my daughter’s Legami pens

by Patrick Vogt

How much is this ice cream – and how long would I have to save up for this doll? Out of nowhere, my daughter has started asking me money-related questions and been secretly raiding her piggy bank. Is it high time to give her pocket money? I sat down with an expert to answer all the most important questions.

Every morning before my daughter leaves for school, I’ve got to body-search her. I go through her pants and jacket pockets as well as backpack on the search for one thing: money.

No, I’m not trying to subject my daughter to an airport security check. But a recent incident has forced my hand – and me into the role of the unwilling marshal. You see, my daughter secretly fished a few coins out of her piggy bank and made a pit stop at the kiosk on her way to school with a friend. I found out about it when she bragged about her sweets spoils at school, which prompted another mum to reach out to me. Child’s play, I know. But despite having a talk with my daughter, I caught her again the very next day with change in her bag. That’s why, ever since, I’ve been doing daily checks before she leaves the house.

The fact is money and the idea of spending it on knick-knacks are heavily on my daughter’s mind. She’s been enjoying role-playing with her friends around an improvised play shop complete with play money. At the swimming pool, she’s been insisting each round of ice cream is paid for from my wallet. In the same breath, she’s been wanting to save up herself for big things on her wish list instead of simply asking for them for Christmas. Is it high time to start giving her pocket money? My husband and I have been mulling over this question. But we have our qualms – she just started first grade. Isn’t that way too early for her to have her own money?

«No,» Philipp Frei assures me during our conversation. And he would know; The 38-year-old is the managing director of Dachverband Budgetberatung Schweiz (English: umbrella organisation for budget counselling) and himself a father of two. It’s my first appointment ever with someone from budget counselling. Together, we go over the most important questions about pocket money.

This is individual and depends on the development of the child, but also on the family’s means. A good time to start is the first grade – when children start learning math. At the same time, Frei stresses that children aren’t entitled to an allowance. «It’s not a parental obligation, but a choice.»

«Yes, because just having pocket money doesn't promote financial literacy,» Frei says. The following questions should be addressed as early as possible: what should the child be able to afford with the money? What shouldn’t they be able to afford? Are they allowed to decide freely what they spend their money on? Or should we as parents have a say? Frei recommends a hybrid solution: define what a portion of the money is for and make the other one available for free spending. «It’s important that the child is able to learn from their own spending mistakes. Mistakes are part of learning.»

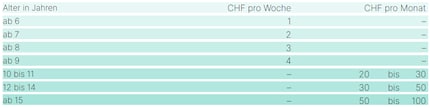

One franc per grade and week is a good place to start. Beginning at around fifth grade, the Dachverband Budgetberatung recommends giving a monthly allowance. «That’s the earliest age that a child is capable of planning their spending over a period longer than just one week.»

However, Frei points out, «The amounts in the table were calculated several years ago and haven’t been adjusted to purchasing power for quite some time.» He therefore recommends that parents focus on the following question: what do I want my child to be able to spend their money on? «If I want them to be able to afford an ice cream a week, then two to three francs a week in allowance would make sense.»

«No,» says the expert. «Pocket money shouldn’t become a means of education.» Neither withholding pocket money as a punishment nor extra money as a reward. After all, money has never worked as a corrective measure. And using allowance as a reward for good grades, for example, isn’t recommended either. «Money is the wrong incentive,» says Frei.

Here, too, the expert says no. When the money is gone, it’s gone – and your child should learn to live with the consequences. But there are exceptions, Frei adds. For example, if the child has to buy their own clothes from their pocket money, and their shoes tear. «If the pocket money has already been spent on other things, parents may give their child an advance in this case. However, the advance should then be deducted from the next allowance until the debt is repaid.»

From about high school onwards, an increase in pocket money – which is expected to cover more expenses – is a sensible step towards more personal responsibility.

The amounts should be based on the parents’ financial circumstances. «We also advise you offer your children support,» says Frei. Meaning? «For example, create a budget together and discuss expenses.»

In the past, this was an easy one to answer: starting with their first apprenticeship salary. But in the era of cashless payments, this age has fallen sharply – «And will continue to sink,» Frei predicts. There are already special bank cards for children. That’s okay, too, as long as it’s not a credit card. He recommends setting up an account for your child when they’re about twelve years old.

My six-year-old is still years away from having her own bank card; for now, we’re starting with some pocket money. Money is still a totally abstract concept to her, anyway. When I recently dismissed an absurd shopping request of hers with, «I don't have any money for that,» she shrugged and said, «Then just go get it with your bank card.» As if the money there was infinite and available to be spent on anything.

Mom of Anna and Elsa, aperitif expert, group fitness fanatic, aspiring dancer and gossip lover. Often a multitasker and a person who wants it all, sometimes a chocolate chef and queen of the couch.

Interesting facts about products, behind-the-scenes looks at manufacturers and deep-dives on interesting people.

Show all